Executive Summary

In June 2021, the Marketing Accountability Standards Board (MASB), issued the landmark publication, The Financial Value of Brands Imperative: Why Brands Must be Valued in Financial Terms. A fundamental premise of the publication is that the measurement and analysis of the Financial Value of Brands [definition] demonstrates the material contribution of brands to the overall value of the enterprise and provides an excellent management decision-making tool to enhance long-term enterprise value. MASB’s key recommendation is that brand-centric enterprises develop an internal methodology to annually measure, explain and report the Financial Value of Brands to the executive level, even in the absence of any external regulatory or accounting requirements.

The publication cited several real-world examples to support this fundamental premise and key recommendation. Not surprising to us at MASB, the passage of time has only further reinforced our positions and conclusions in the original publication.

The Impact of Brands on Market Capitalization

The June 2021 publication stated, “For brand-centric companies, it is increasingly clear that the primary driver of market capitalization (i.e. enterprise value) is the future anticipated stream of cash flows generated by their brands, and the magnitude of this brand-value impact is closely tied to the relative success in growing those future cash flows.” [1]

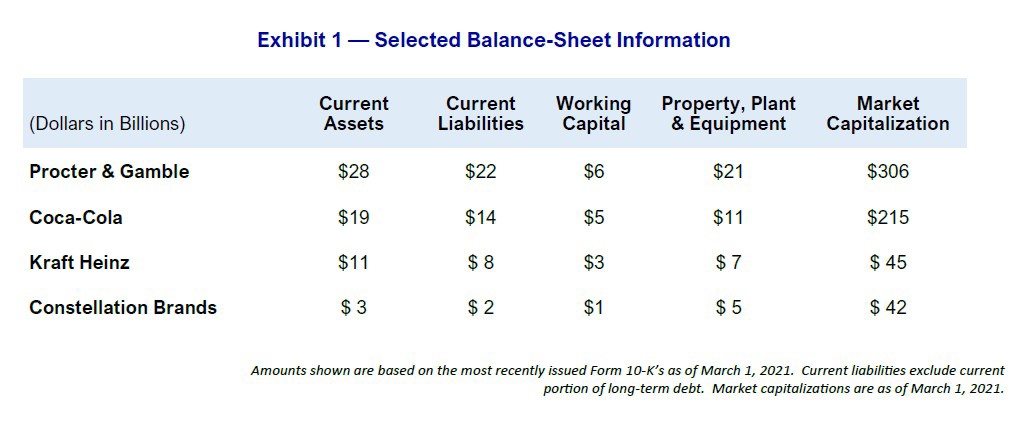

We profiled four brand-centric companies to illustrate their extremely low level of tangible assets relative to market capitalization as shown below in Exhibit 1.

Let us look at how these companies have performed since then in terms of enterprise value (as measured by stock market capitalization, in billions):

| Mar 1, 2021 | Oct 28, 2022 | % Change | |

| Procter & Gamble | $306 | $321 | +5% |

| Coca-Cola | $215 | $263 | +22% |

| Kraft Heinz | $45 | $48 | +7% |

| Constellation Brands | $42 | $47 | +12% |

| S&P 500 Index | 3,902 | 3,901 | flat |

For proponents of the Financial Value of Brands, it is reassuring to see that each of these four brand-centric companies out-performed the stock market as a whole, though it is a given that many factors impact stock prices over time as well as between two specific points in time.

Results and management commentary from recent quarterly earnings announcements also help provide a bit more color and insight. Financial results are routinely explained by four drivers: volume, price, mix and cost.

Price may manifest itself either in the purchaser’s willingness to pay more or the purchaser’s acceptance to pay a non-promoted price versus a discounted price. Both work in favor of the successful marketer. For brand-centric (especially international) consumer products companies, price can help to offset/overcome recent headwinds relating to cost inflation and unfavorable foreign exchange impacts. Procter & Gamble announced its first quarter fiscal 2023 results on Oct. 19, 2022. Procter & Gamble reported that its organic sales increase for the quarter was driven by a 9% consolidated increase in pricing, achieving higher pricing that ranged from 6% to 11% in each of its five reporting segments. [2]

Coca-Cola reported its third quarter calendar 2022 results on Oct. 25, 2022. Their results highlighted 16% growth in organic revenues including 12% growth in price/mix and 4% volume growth. Chairman and CEO James Quincey remarked, “Our business is resilient amidst a dynamic operating and macroeconomic environment. We are investing in our strong portfolio of brands, which is a cornerstone of our ability to deliver long-term value for our stakeholders.” [3]

Kraft Heinz reported its third quarter calendar 2022 results on Oct. 26, 2022. Their results highlighted 12% growth in organic net sales including 15% growth in price with a -3% offset in volume/mix. Chairman and CEO Miguel Patricio commented, “We’re dedicated to providing solutions for consumers by leveraging the power of our brands to deliver on value at a time when consumers need it the most… We remain focused on advancing our long-term strategy, and believe we are well-positioned to drive profitable growth and generate attractive returns for our stockholders.” [4]

In its second quarter fiscal 2023 results published on Oct. 6, 2022, Constellation Brands’ Beer segment posted depletions (volume) growth of nearly 9%. President and CEO Bill Newlands stated, “Our core beer brands, Modelo Especial and Corona Extra, continue to outshine the market, and our next wave brands, Pacifico and Modelo Chelada, are achieving strong double-digit growth.” Specifically, in IRI channels, Constellation Brands’ Beer segment was the #1 share gainer in industry market dollar share, adding 1.8 points in the beer category and 2.5 points in the high-end beer segment. [5]

Another brand-centric company cited in the June 2021 publication was Hostess Brands. We stated, “A specific case example of rejuvenating a brand and adding to enterprise value is that of Hostess Brands. In 2013, facing potential bankruptcy or liquidation, certain snack-cake products under the Hostess and Dolly Madison brand names were purchased by a private investment group for about $410 million. By 2016, the ‘new’ Hostess Brands announced it was considering an initial public offering for an estimated $2.3 billion. The IPO never materialized; rather, the transaction to become a public company was executed through a special-purpose acquisition company process. Hostess Brands continues to trade publicly under the ticker symbol TWNK (a reference to the Twinkies Brand) and had a market capitalization of about $2 billion in early 2021.”

At the market close on October 28, 2022, TWNK’s market capitalization was $3.6 billion, trading at its all-time closing high since going public.

Marketing Spending as a Growth Driver

Specific to Constellation Brands, the June 2021 publication stated, “In its Fiscal Year 2020 Management’s Discussion and Analysis, in reference to the Beer segment’s increasing selling, general and administrative expenses, Constellation highlights: ‘The increase in Beer is primarily due to an increase of $76.0 million in marketing spend… The increase in marketing spend is due to planned investment to support the growth of our Mexican beer portfolio.’ With recent beer volume performance in these challenging times of the pandemic increasing by mid- to high-single digits, Constellation appears to be stoking the consumer-demand fire with additional marketing pressure. Could it be that Constellation is quite deliberately investing more in marketing and selling activities to drive brand preference, generating incremental cash flow and leading to an increase in enterprise value? A quick study of Constellation’s Form 10-Ks suggests that the answer to that question is an emphatic ‘yes.'”

We then presented the chart below (Exhibit 2) derived from Constellation’s Management’s Discussion and Analysis, showing the annual increases in Beer segment Marketing Spending and Operating Income, respectively.

Two fiscal years have since passed for Constellation. Over those two fiscal years for the Beer segment, Marketing Spending increased $62 million, and Operating Income increased $455 million. Let us repeat what we stated in our June 2021 publication, “Generating incremental cash flow, indeed!”

Brand Weakness Can “Taketh Away”

From the June 2021 publication, “More recently, Adidas’ announcement to potentially sell off Reebok provides an example of how abandoning brand support can lead to deteriorating business results that contribute to a decline in the Financial Value of Brands. Adidas announced it would purchase Reebok in August 2005 for $3.8 billion, an acquisition which closed only five months later on Jan. 31, 2006. With the passage of time, Reebok, among other things, began to lose its contracts to manufacture sports uniforms and apparel for professional sports leagues and college teams. Former NBA star Shaquille O’Neal, whose history with Reebok dates back to the 1990’s, said in 2019 that he wanted to buy Reebok because Adidas has ‘diluted [the brand] so much to where it’s almost gone.’ Reebok has faced a series of impairment charges from 2013 to 2020, culminating in a dramatically lowered book value of $995 million.”

Adidas announced in August 2021 that it would sell Reebok to Authentic Brands Group for $2.5 billion, $1.3 billion lower than what it paid for the brand 16 years earlier. The sale of Reebok was finalized in March 2022.

In the June 2021 publication, we profiled Boston Beer’s Truly Hard Seltzer brand, stating the following: “Truly was introduced in 2016 into the new hard seltzer category within alcoholic beverages. Boston Beer’s public statements, coupled with those from beverage industry media, clearly tell the story of a growing hard seltzer category, and Truly’s market share, while number two behind Mark Anthony Brands’ White Claw, has been growing within the hard seltzer category. Pricing seems rational with slightly increasing cost of goods, but these elements pale in monetary impact to the volume and share story. Accordingly, Boston Beer has been very clear about its commitment to increasing marketing support behind Truly. With a market capitalization well over $10 billion that has more than quadrupled since the introduction of Truly, one might ask, what other sensible options are there?”

As of Oct. 28, 2022, Boston Beer’s market capitalization has declined to just under $5 billion, and its struggles since mid-2021 with the Truly Hard Seltzer brand have been well documented in public disclosures.

Just as strong brands “giveth” in terms of enterprise value, brand weakness can “taketh away.”

The Continuing Under-Utilization of CMOs

A provocation from the June 2021 publication was, “If you asked most people who the Chief Asset Steward is at a public company, the most frequent response would likely be the Chief Financial Officer. Based on what we have now discussed, could it be that the Chief Marketing Officer is really the Chief Asset Steward at a brand-centric company? Even if only partly true, it calls into question the board compositions of many companies – which tend to have few if any marketing experts – and the pervasive lack of CMO participation in quarterly earnings calls.”

Using the same four brand-centric companies cited earlier, here were the participants in their October 2022 quarterly earnings calls:

- Procter & Gamble: Vice Chairman and COO; CFO

- Coca-Cola: Chairman and CEO; CFO; Vice President of Investor Relations, Financial Planning, and Analysis

- Kraft Heinz: CEO and Director; Global CFO; Zone President of International; U.S. Zone President; Head of Global Investor Relations

- Constellation Brands: CEO; CFO; Vice President, Investor Relations

Not surprising to MASB, despite the emphasis on brand and marketing generated revenue and margin growth, there was no CMO participation in any of these earnings calls.

Porsche: Another Case Study in Brand Value

Porsche, the 91-year-old German company behind iconic models like the 911, became a breakout star of the financial markets when it began trading on the Frankfurt Stock Exchange on Sep. 28, 2022, in one of Europe’s largest initial public offerings ever. The enterprise valuation of Porsche on the first day of trading was $75 billion. [6]

Subsequently in early October, Porsche’s market capitalization rose to over $80 billion which put its valuation ahead of Volkswagen’s at just under $80 billion. This is a curious occurrence given that Volkswagen still owns 75% of Porsche after the IPO. [7]

THE PATH FORWARD

The impetus for MASB’s June 2021 publication came from the discovery that despite the obvious connection between brand building and marketing activities and the meeting of long-term monetary goals, the financial value of brands is not systemically monitored or analyzed in most organizations. This is a significant gap given the substantial contribution of brand intangible assets to enterprise value. Like all the other assets of the company, brands should be invested in, put to work to generate value, and held acountable for the results.

MASB’s subsequent research concluded that to fill this gap, brand-centric enterprises should develop an internal methodology to annually measure, explain, and report the financial value of their brands to the executive level, even in the absence of any external regulatory or accounting requirements.

The importance of this goes far beyond financial reporting. A robust brand valuation is a strategic management decision making tool. It goes beyond the what, the point-in-time number, to determine how brand and marketing work in the business to drive revenues and profits. This allows management to identify the brand strategies and marketing investments which will add the greatest financial value to the enterprise. Businesses which use brand financial analysis this way can achieve significant incremental growth and market share gain. Brand valuation can and must be used as a management decision-making tool with the end goal of enhancing enterprise value.

MASB has examined a number of different brand valuation methodologies. The June 2021 publication summarizes the approaches of several leading measurement providers, whose services have the potential to be used for both reporting and decision-making.

Financial Value of Brands Review Available

To help brand owners introduce regular measurement of financial brand value, MASB is also offering a turn-key program for either individual or multiple brands. This program provides an independent expert review of the measurement needs of each participating brand owner and facilitates the selection of a suitable approach and provider. MASB oversees the initial valuation, the results of which are verified by MASB experts, and recommends the best path forward for continuing valuations.

|

The Financial Value of Brands Imperative: Why Brands Must be Valued in Financial Terms ORDER NOW as a digital PDF direct from MASB |

To receive the publication or to pursue participation in the program, please email info@themasb.org.

Author

Jim Meier served as MASB Director (2013-2018) and was appointed Trustee and Treasurer of the Marketing Accountability Foundation in 2019. He graduated from Marquette University in 1984 with a Bachelor’s degree in Accounting. After 8 years as an auditor with Ernst & Young, he spent 26 years with Philip Morris, Miller Brewing Company and MillerCoors in financial support roles across Corporate Financial Services, Sales, Integrated Supply Chain, and Marketing. In his final role, VP Commercial Finance, Jim reported directly to the CFO and on a dotted-line basis to the CMO and CSO. He was closely involved with annual marketing spending allocation, on-going assessment of marketing mix modeling, and application of ROMI principles in both the Marketing and Sales divisions. Most recently, Jim has been engaged in assisting startup companies connected with a venture capital fund.

Jim Meier served as MASB Director (2013-2018) and was appointed Trustee and Treasurer of the Marketing Accountability Foundation in 2019. He graduated from Marquette University in 1984 with a Bachelor’s degree in Accounting. After 8 years as an auditor with Ernst & Young, he spent 26 years with Philip Morris, Miller Brewing Company and MillerCoors in financial support roles across Corporate Financial Services, Sales, Integrated Supply Chain, and Marketing. In his final role, VP Commercial Finance, Jim reported directly to the CFO and on a dotted-line basis to the CMO and CSO. He was closely involved with annual marketing spending allocation, on-going assessment of marketing mix modeling, and application of ROMI principles in both the Marketing and Sales divisions. Most recently, Jim has been engaged in assisting startup companies connected with a venture capital fund.

Sources

- The Financial Value of Brands Imperative: Why Brands Must be Valued in Financial Terms; Marketing Accountability Standards Board, June 2021.

- Procter & Gamble press release, Oct. 19, 2022.

- Coca-Cola press release, Oct. 25, 2022.

- Kraft Heinz Reports Third Quarter 2022 Results, Businesswire, Oct. 26, 2022.

- Constellation Brands press release, Oct. 6, 2022.

- de la Merced, Michael J. Porsche Shares Jump in Blockbuster Market Debut; The New York Times, Sep. 29, 2022.

- Porsche overtakes Volkswagen as Europe’s most valuable carmaker; Reuters; Oct. 6, 2022.