Part 1 provides an overview of the current state of sponsorship use and management.

Part 1 provides an overview of the current state of sponsorship use and management.

Part 2 explores the long-term nature of sponsorship relationships and the resulting importance of fit between properties and brands.

Part 3 establishes the importance of developing the business case for sponsorship as well as contractual considerations.

Part 4 sets forth best practices in sponsorship stewardship and activation.

Part 5 provides an examination of the measurement of sponsorships.

Part 6 explores eSports as a fit for a brand’s sponsorship portfolio.

Part 7 addresses the COVID-19 pandemic and complements the previous installment on eSports.

Part 8 examines the role social media plays in managing and measuring sponsorships.

Part 9 reviews the emerging opportunity brought about by student-athlete “rights to publicity” decisions.

Part 10 looks at what we learned from the first year of college athlete sponsorship.

In this third part, we examine the importance of establishing a business case for sponsorship investments and how laying a strategic foundation aids in the creation of a robust pro forma. This pro forma is used to align the work of the various corporate functions and inform on measurement and contractual needs.

Sponsorship accountability starts with a business case

A common sentiment uncovered in an ANA/MASB survey of sponsoring companies was a lack of confidence in the business case for these investments. Even among the thirty-seven percent of companies with a standardized measurement process, less than half were satisfied with their ability to isolate its impact. This made it very difficult for them to establish a business case as summarized by one participating senior marketer:

“While we could estimate some dollar values, what it’s worth per percentage point of awareness or familiarity of whatever that might be, it’s a pretty artificial exercise.” [Verbatim response to ANA/MASB Sponsorship Survey, 2018]

Developing a pro forma sponsorship business case with projected returns should not be viewed as a theoretical exercise as it provides three practical benefits:

- It establishes a shared vision for expectations of sponsorship impact that can be shared across Finance, Sales and Marketing functions, for the duration of the contract. It should include estimates of Return on Objectives, consistent with the sponsorship strategy. These are typically consumer opinions and behaviors associated with the purchase journey. Similarly, all costs associated with the sponsorship, including those not paid to the property, (ex: activation expenses and funding of research/measurement) should be included. To illustrate, let’s assume there is a 10-year contract with an expectation of incremental sales due to the sponsorship. Part of the pro forma business plan would include an analysis of how many incremental sales would be necessary for the sponsorship to break even. From this it is possible to estimate a range of results that, if achieved, would be considered a success. By calculating cost per incremental sale for the sponsorship, it is also possible to evaluate whether there are more efficient means other than sponsorship to achieve these results.

- It becomes a roadmap for required research and measurement of consumer response, (both attitudes and behavior) to determine if the sponsorship is delivering the expected influence. For example, if the sponsor is expecting their involvement to result in consumers thinking their brand is more youthful, measuring the attitudes of fans/attendees vs. those of non-fans and those not in attendance would determine whether image ratings are changing among participants.

- It aids understanding of “what must be true” to achieve expected outcomes for both the property as well as the Sponsoring brand, which has implications for contractual language. This can be as elementary as codifying expectations of earned media value, perhaps because the team being sponsored has a recent bout of wins that may not be sustainable. Experienced sponsors have moved from contracts with fixed fees to performance-based incentive payments in their contracts to protect against this risk. Additionally, savvy sponsors will include contract language that allows for access to fans/attendees to conduct independent research.

Over time the pro forma expectations, when compared to actual outcomes, create a valuable data resource for making future sponsorship decisions. This enables continuous improvement and becomes a tool for managing the sponsorship portfolio. For this reason, MASB recommends implementation of a systematic business case process across all sponsorships – a best practice among successful sponsors.

Going deeper on the pro forma and contractual language

Two common mistakes should be avoided when creating the pro forma. They are underestimating activation costs and failure to include sufficient budget for measurement. These aspects are also critical to determining sponsorship impact and return and will be covered in future parts of this series.

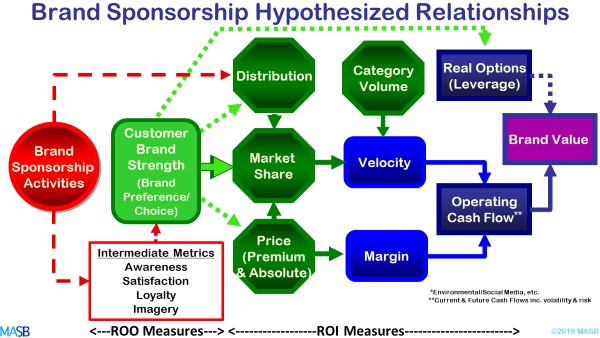

Below is a framework of the potential relationship linkage between brand sponsorship activities, return on objective measures and financial outcomes. These relationships vary based on the sponsoring brand objectives which is why the chart is titled “hypothesized.” The framework may be helpful in several ways when developing the pro forma business case.

First, think of brand sponsorship activities as inputs that will generate ROO/ROI outcomes, ultimately resulting in increased brand value. Second, the particular path each brand will prioritize for its sponsorships will depend on the business case – what does the brand need – and what outcomes can be driven most efficiently.

Says MASB Advisor Jim Meier, “While a precise financial business case for a sponsorship seems elusive, don’t let perfection be the enemy of the good. Have a reasonable starting expectation, measure and refine, which helps address FOMO (fear of missing out) and FONR (fear of non-renewal).”

Contract language is the means by which performance, access and flexibility can improve value

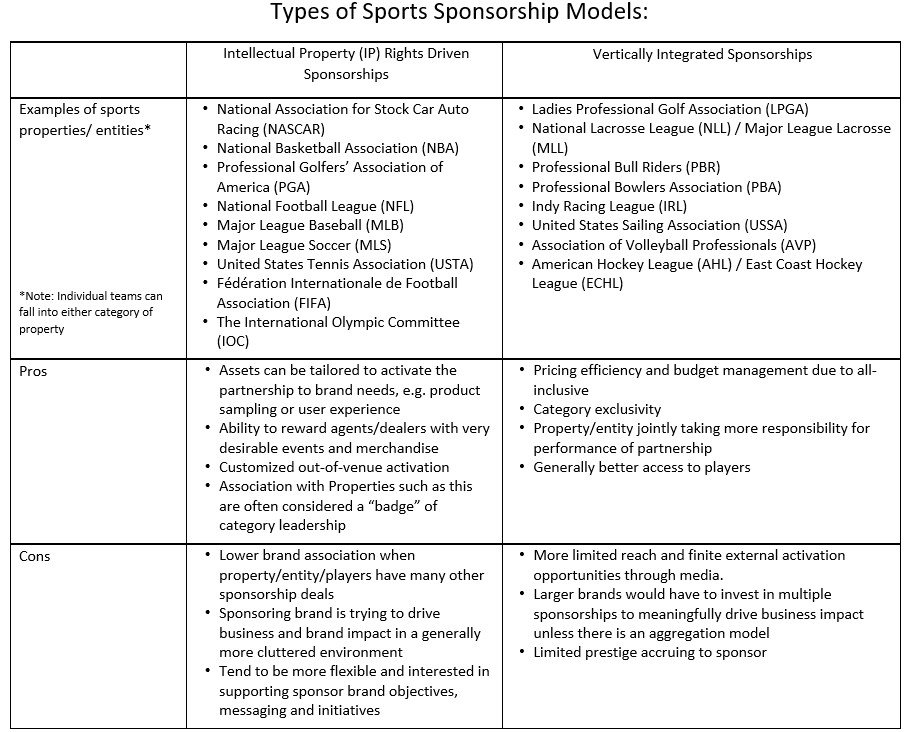

There’s growing recognition on the part of rights holders that sponsoring brands have a legitimate desire to demonstrate that they are gaining value from sponsorships. The power is beginning to shift from what the property rights holders want to sell, to what brands need to buy. For example, sports properties are oftentimes de-facto content and media companies, controlling ancillary intellectual property (e.g. logos, video clips, streaming content) as well as the sport and competition itself. This results in two distinct types of sponsorships:

- Intellectual property rights driven properties where the sponsor primarily buys the rights to use the team’s logo, name or likeness on a specific asset such as a lock-up on packaging, a promotion, end-cap store display, or in a print, linear television or digital advertisement. In this case, the actual assets and impressions purchased from the property generally constitute a small percentage of the value/price of the deal. Additionally, they are often non-exclusive and not ambush-proof, in part because it is possible to purchase commercial media units, features and other assets from media partners such as streaming companies, local stations and national networks.

- Vertically integrated properties which involves the sponsor purchasing a 360-degree all-encompassing ‘package deal,’ usually for a sports team, growth/niche sports property, league or tour. Messaging is displayed in ‘surround sound’ on air, online, in-venue or on players and/or teams. Onsite, online and on-air assets are included in the price and generally constitute a larger percentage of the total price/value of the deal. In many product and service categories, the best deal practice affords exclusivity and offers some level of ambush proofing.

In both cases, it’s important for the sponsor and its agencies and consultants to protect sponsor rights and exclusivities, or they may opt to go a non-official sponsorship route. This essentially entails forgoing purchasing the league or tour sponsorship and instead deploying available budgets to buy media and spokespeople who may do more to drive brand KPIs and enable them to meet and exceed business and marketing objectives. This route may be the best alternative to drive association and business impact in a cost-efficient fashion.

We will use the matrix below to illustrate the key pros and cons from the two main types of sponsorships. It is limited to just sports properties (which represent about 70% of total sponsorship spending) though the same logic can be applied to other venues.

Best Practices and Recommended Approach – Contractual Considerations

Now that we have reviewed the pros and cons of the two types of sponsorship models, we will have a closer look at best practices and considerations in developing powerful contract language.

For general terms such as exclusivity, clutter, performance clauses and deliverables on the part of the property:

- Ensure that fragmentation of media rights, use of endorsers, and content does not create an opportunity for a competitor to create consumer or key constituent perception of being the actual sponsor thereby diffusing the sponsor’s benefit.

- Include details on right of ‘first refusal’ on renewal, control of price increase on early renewal, and/or category exclusivity.

- Incorporate a ‘clutter guarantee’ making it relatively easy to notice the sponsoring brand’s logo in a clear and impactful manner.

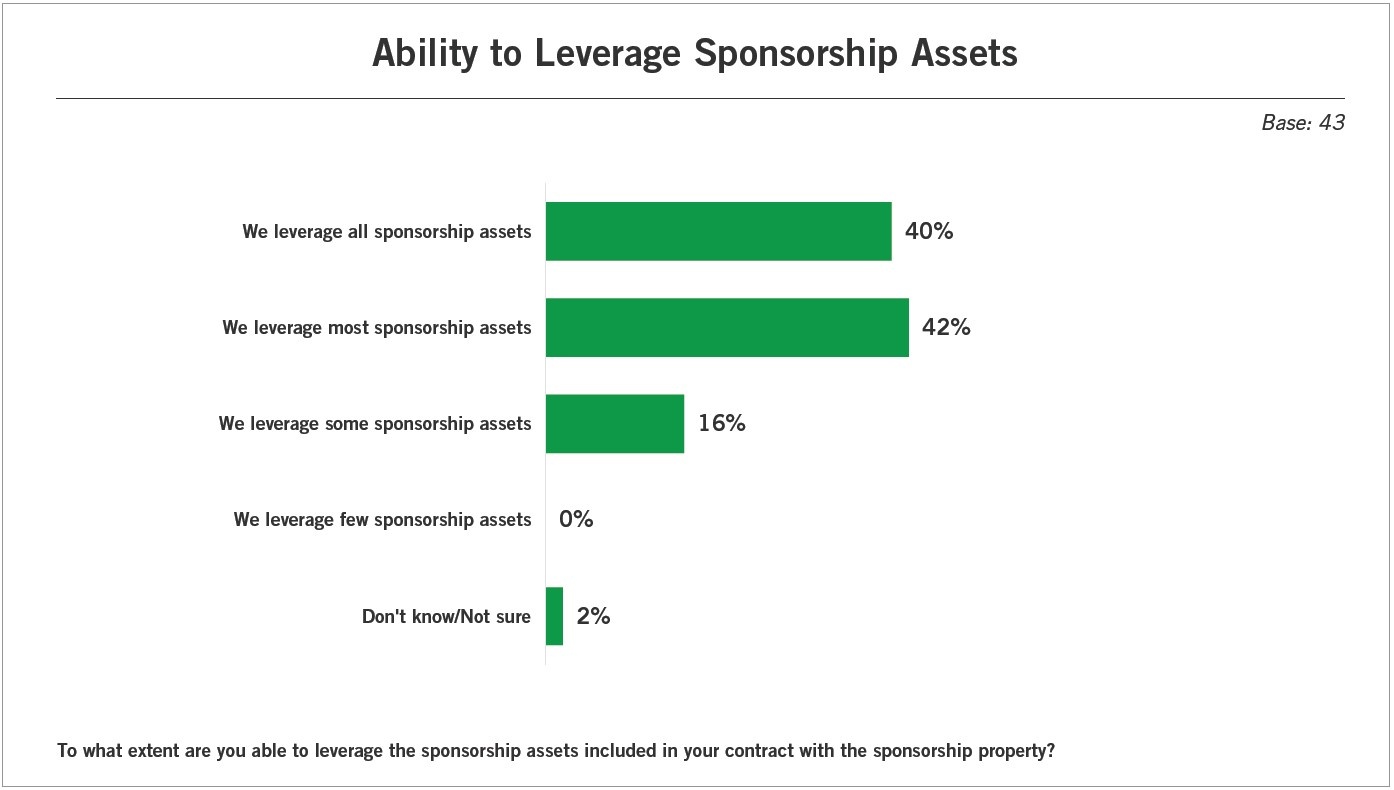

Paying for sponsorship assets, without an intent to leverage such assets, diminishes ROI and should be removed from the contract, and accordingly the price. In the 2018 MASB/ANA Sponsorship survey[1] of leading advertisers, only 40% of companies surveyed indicated they leveraged all assets—suggesting significant opportunity for improvement.

The top reported reasons for being unable to leverage assets were:

- Internal resources/bandwidth

- Some assets are less important than others

- Budget constraints

In lieu of accepting contact language with standard package inclusions, it is better to create a customized package of assets and services aligning with brand objectives and activation plans, which should be in place in advance of executing the sponsorship contract. Developing a prioritized rank of assets to be used in pre-contract negotiations is helpful. When the sponsorship contract is nearly complete, a new ranked prioritization based on firsthand experience aids renewal negotiations.

Examples of assets included that have high likelihood of not being leveraged – or that are not worth a premium – can include tickets, personal appearances and an excess of media units if not supported by an adequate pool of creative executions for commercial rotation to avoid message wearout.

Access to Fans and Attendees

Clearly defined expectations regarding access to fans/attendees should be part of sponsorship contract language. Successful sponsoring brands use access to pre-test/research activation concepts, conduct independent measurement of sponsorship impact, and determine the effectiveness of their ability to interest and engage the target audience while on-site and via follow-up contact. Typically, the language includes timelines for approvals (creative, activation, measurement) as well as any limitations on where or how fans/attendees can be contacted.

The absence of this language can negatively influence sponsorship return due to restrictions on the sponsoring brand’s storytelling in activation and validation of consumer impact.

“Maximizing the sponsor’s access to customers increases the direct sales element of sponsorship ROI. In college sports this often comes down to how it is permissible and effective to connect with alumni. Building a “flex” budget into the sponsorship allows for securing more assets once it becomes clear which ones can be best leveraged to drive achievement of business KPIs.”

Ray Katz, Chief Operating Officer, Collegiate Sports Management Group

The ability to change the mix of assets being used over the duration of the contact, when codified in the contract, aids the sponsoring brand’s ability to change out assets as their contribution to performance is realized. This flexibility has been successfully used to ensure there is no fee or new legal document required when such a change is sought by the sponsor. Sometimes the language specifies the number of allowable “change orders” that can occur over the life of the contract without incurring a charge. One helpful strategy is to define what percentage of total sponsorship value may be changed during the term.

“At BBVA, we calculate Return on Asset (ROA) year over year. This process entails understanding how much each asset in the contract is worth. Our assets are given a specific value by a third party agency based on total investment. We then set KPIs that are important to the actual value of the assets. For example, a signage asset KPI could be the average attendance at the arena, or the average TV viewership throughout the season. That is what makes the asset valuable to us. This type of exercise is great for differentiating between high and low performing assets. Asking a partner to be flexible is a much easier conversation when you have the numbers to help optimize your partnership. We have seen that working well so far. We have great partners.”

Hugo Lagarda, Manager of Strategic Partnerships, BBVA

BBVA in the USA: The Journey to Financial Measurement of Sponsorships; 2019 MASB Winter Summit

The pro forma business case and contractual language are two critical means of improving sponsorship accountability and return. They also have downstream implications for stewardship, activation and measurement, which will be detailed in the next installments in MASB’s series on Sponsorship Accountability.

References

[1]Source: Improving Sponsorship Accountability Metrics, ANA/MASB, July 2018.

Contributor

Ray Katz is Chief Operating Officer and Co-founder at Collegiate Sports Management Group and Managing Partner at ROI Sports Group, as well as Adjunct Professor of Sports Management at Columbia University. He has worked for the NFL, The Football Network and several marketing communications agencies. He also founded Smartix International. He serves on the MASB Sponsorship Accountability Metrics Project team. Thank you for your valuable contribution!

Ray Katz is Chief Operating Officer and Co-founder at Collegiate Sports Management Group and Managing Partner at ROI Sports Group, as well as Adjunct Professor of Sports Management at Columbia University. He has worked for the NFL, The Football Network and several marketing communications agencies. He also founded Smartix International. He serves on the MASB Sponsorship Accountability Metrics Project team. Thank you for your valuable contribution!

About the Authors

Tony Pace is President/CEO of MASB. He brings extensive experience from across the marketing spectrum, in roles of increasing responsibility at advertising agencies and as a marketing leader. At Young & Rubicam and McCann-Erickson, he led brands such as KFC, Coca-Cola and Capital One. In addition to his client leadership responsibilities, Tony oversaw both revenue generation and P/L responsibility as General Manager of McCann Southwest and co-founder of Momentum, IPG’s global experiential marketing firm. As CMO of Subway, he grew that brand to #2 in market share in the U.S. and #1 in locations worldwide. During his tenure, Subway’s brand value, as tracked by Millward Brown’s Brand Z assessment, rose from unranked to #40 (over $22 billion). Tony’s goal with MASB is to raise the profile and influence of the organization to the benefit of the marketing community. He earned his undergraduate degree at the University of Notre Dame and MBA in Finance from The Wharton School at the University of Pennsylvania

Tony Pace is President/CEO of MASB. He brings extensive experience from across the marketing spectrum, in roles of increasing responsibility at advertising agencies and as a marketing leader. At Young & Rubicam and McCann-Erickson, he led brands such as KFC, Coca-Cola and Capital One. In addition to his client leadership responsibilities, Tony oversaw both revenue generation and P/L responsibility as General Manager of McCann Southwest and co-founder of Momentum, IPG’s global experiential marketing firm. As CMO of Subway, he grew that brand to #2 in market share in the U.S. and #1 in locations worldwide. During his tenure, Subway’s brand value, as tracked by Millward Brown’s Brand Z assessment, rose from unranked to #40 (over $22 billion). Tony’s goal with MASB is to raise the profile and influence of the organization to the benefit of the marketing community. He earned his undergraduate degree at the University of Notre Dame and MBA in Finance from The Wharton School at the University of Pennsylvania

Karen Ebben, MASB Director, is President of Global Marketing Impact, LLC. An award-winning Fortune 100 Marketing and Advertising executive with 20+ years of global analytics, research & consumer insights experience, she is a consultant specializing in improving marketing effectiveness. Previously, she was Director of Global Advertising & Marketing Effectiveness for General Motors, where she accelerated improvements in marketing accountability. Her work has earned Cannes, AME, DMA and Effie recognition. Karen’s sponsorship experiences span negotiation, strategy, activation & measurement of Olympics, Golf, Fashion Week, Motorsports, Disney Test Track and other entertainment and cause related venues. She co-leads MASB’s Sponsorship Accountability Metrics (SAM) and Marketing Metric Catalog (MMC) initiatives.

Karen Ebben, MASB Director, is President of Global Marketing Impact, LLC. An award-winning Fortune 100 Marketing and Advertising executive with 20+ years of global analytics, research & consumer insights experience, she is a consultant specializing in improving marketing effectiveness. Previously, she was Director of Global Advertising & Marketing Effectiveness for General Motors, where she accelerated improvements in marketing accountability. Her work has earned Cannes, AME, DMA and Effie recognition. Karen’s sponsorship experiences span negotiation, strategy, activation & measurement of Olympics, Golf, Fashion Week, Motorsports, Disney Test Track and other entertainment and cause related venues. She co-leads MASB’s Sponsorship Accountability Metrics (SAM) and Marketing Metric Catalog (MMC) initiatives.

Henrik Christensen, MASB Advisor, is the former VP Global Insights, Foresight and Analytics at Molson Coors where he led a team that created enterprise-wide capabilities on advanced analytics, shopper and consumer insights. Key responsibilities included global insights partnerships, consumer/sales testing tools, marketing mix modeling and other advanced analytics. He stewarded Molson Coors’ global insights and analytics ambition and was a member of its enterprise growth team. He’s a member of MASB’s Sponsorship Accountability Metrics (SAM) team and drives best practices in sponsorship from inception of strategy to implementation of measurement protocols.

Henrik Christensen, MASB Advisor, is the former VP Global Insights, Foresight and Analytics at Molson Coors where he led a team that created enterprise-wide capabilities on advanced analytics, shopper and consumer insights. Key responsibilities included global insights partnerships, consumer/sales testing tools, marketing mix modeling and other advanced analytics. He stewarded Molson Coors’ global insights and analytics ambition and was a member of its enterprise growth team. He’s a member of MASB’s Sponsorship Accountability Metrics (SAM) team and drives best practices in sponsorship from inception of strategy to implementation of measurement protocols.

MASB Sponsorship Accountability Series edited by Frank Findley and Erich Decker-Hoppen